If you're looking to form an LLC in KS, you'll want to follow specific procedures to ensure a seamless process and within legal bounds. From picking a name that meets legal requirements to ensuring you’ve got someone managing legal documents, every action counts. Establishing an operating agreement and keeping up with official timelines might seem overwhelming, but it's entirely feasible. Want to avoid common mistakes? Learn the exact steps involved.

Selecting a Unique Name for Your Kansas LLC

Prior to documentation submission, you’ll need to choose a unique name for your Kansas LLC. Your business name must differently identify your company from others on record with the State of Kansas Secretary.

Verify the official business name database to ensure your preferred name is available. Your LLC’s name must include “Limited Liability Company,” “LLC,” or “L.L.C.” Don’t use words reserved for banks or insurance unless you meet special requirements.

Make sure your business designation is not deceptive or confusable with current companies. After finding a appropriate, untainted name, you’re ready to move to the next step in formation.

Designating a Registered Agent

Every KS LLC needs a registered agent to receive legal documents and legal notices on behalf of the company. You can’t skip this step—designating an official representative is required by state law.

Your registered agent must have a physical street address in KS, not just a postal box. You can name yourself, another member, or hire a professional service. Whomever you select, they must be available during regular business hours to ensure you never miss important paperwork.

Selecting a dependable representative helps your LLC maintains its good standing and guarantees you’re always informed of critical legal matters.

Filing Your Articles of Organization

The following essential task is submitting the organizational articles with the Kansas Secretary of State. This form legally establishes your LLC in KS.

Complete the form electronically or download it from the Secretary of State’s online portal. You’ll need your LLC’s name, key agent details, mailing address, and the organizers' names.

Double-check all information to ensure correctness—mistakes can delay the process or even lead to disapproval. Submit the state filing fee, then submit the completed form electronically or by post.

Once validated, you’ll receive a confirmation, formally acknowledging your LLC. Keep this confirmation for your business records and as a future reference.

Drafting an Operational Contract

Even though Kansas doesn't require an operating agreement for your LLC, drafting one is a smart move to establish clear rules and member responsibilities.

With an operational contract, you’ll detail each partner’s privileges, duties, and profit participation or loss allocations. This charter can also define vote processes, organizational hierarchy, and regulations for adding or expelling partners.

By putting everything in writing, you’ll reduce potential conflicts and protect your business’s status as a separate legal entity. Even if you’re the sole proprietor, such documentation can showcase get more info professionalism and prevent discrepancies or misunderstandings down the road.

Don't overlook this task.

Adhering to Kansas State Requirements

Once you've addressed its domestic structure with an operational plan, it's time to turn attention to compliance with state mandates.

Submit your incorporation articles with the Kansas Secretary of State, via electronic submission or postal services. Designate an official representative with a valid physical location in Kansas who can receive legal papers on your behalf. Don’t forget to pay the appropriate filing fee.

After formation, KS mandates the filing of an yearly statement by the 15th day of the fourth month after your fiscal year ends. Missing this deadline could lead to penalties or automatic disbandment.

Conclusion

Forming an LLC in KS is straightforward when you follow the right steps. Begin with selecting a distinct name, appointing a registered agent, and filing your Articles of Organization. Even though it’s optional, drafting an operating agreement helps prevent future misunderstandings. Remember to handle annual reports to maintain compliance. By taking these steps, you’ll prepare your enterprise for compliance, protection, and long-term success. Now, you're prepared to get started!

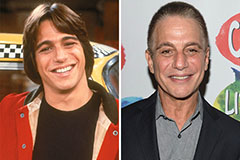

Tony Danza Then & Now!

Tony Danza Then & Now! Mike Vitar Then & Now!

Mike Vitar Then & Now! Shane West Then & Now!

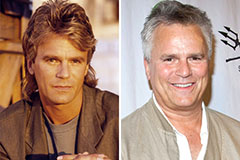

Shane West Then & Now! Richard Dean Anderson Then & Now!

Richard Dean Anderson Then & Now! Mike Smith Then & Now!

Mike Smith Then & Now!